join pilgrim

we’re hiring the best in the business. full stop. if that’s you, it’s time to raise your hand.

a note from

our ceo

I’m from a small town in East Texas where hard work is a part of life, and I took that hard work into the mortgage industry 23 years ago, used that to grow the business and build relationships over time and it got us where we are today.

We’re a company that’s build to last — and that starts with hiring the right people. Not taking on everyone that has an LO license, but taking on the right ones.

Our main mission is that we give you the absolute best experience that you can get from any lender in the nation. You can then turn around and give the absolute best mortgage experience to your buyers, your realtors and your builders. It’s as simple as that.

Loan Officers deserve more than just a login and a pat on the back. What they really need is somebody that has their back — people that care, that have the experience, that are in the trenches with them to get the job done. When we deliver on our promises to them, Loan Officers can then deliver on the promises they make out to the field: to their buyers, to their agents, to their builders.

Wes Kleckley, CEO & Owner, Pilgrim Mortgage

request

more info

Swipe to Explore

Your Transition Team

-

Wes Kleckley

CHIEF EXECUTIVE OFFICER, OWNER

-

Carter Arey

VP, GROWTH & DEVELOPMENT

-

Mandy Jackson

EXECUTIVE ASSISTANT, OFFICE MANAGER

-

MILES HARRIS

LOAN PRODUCTION MANAGER

-

Ginger Lambert

HR & PAYROLL COORDINATOR

the details of

pilgrim Mortgage

privately owned

flat organizational structure

complete transparency

direct access to decision makers

collaborative culture

empowered employees

our core values

whatever it takes

We approach every challenge with determination, resourcefulness, and a commitment to getting the job done right. It means going above and beyond expectations, finding solutions, not excuses, and doing what’s necessary to deliver for our clients, company, and mission.

be real, be reliable

We lead with honesty and authenticity, showing up as our true selves and keeping our word. Being real builds trust and being reliable earns it. Together, they create lasting relationships and consistent results.

dream big together

We believe the best ideas and achievements come from shared vision and teamwork. By dreaming big together, we inspire one another, push boundaries, and turn collective goals into meaningful success.

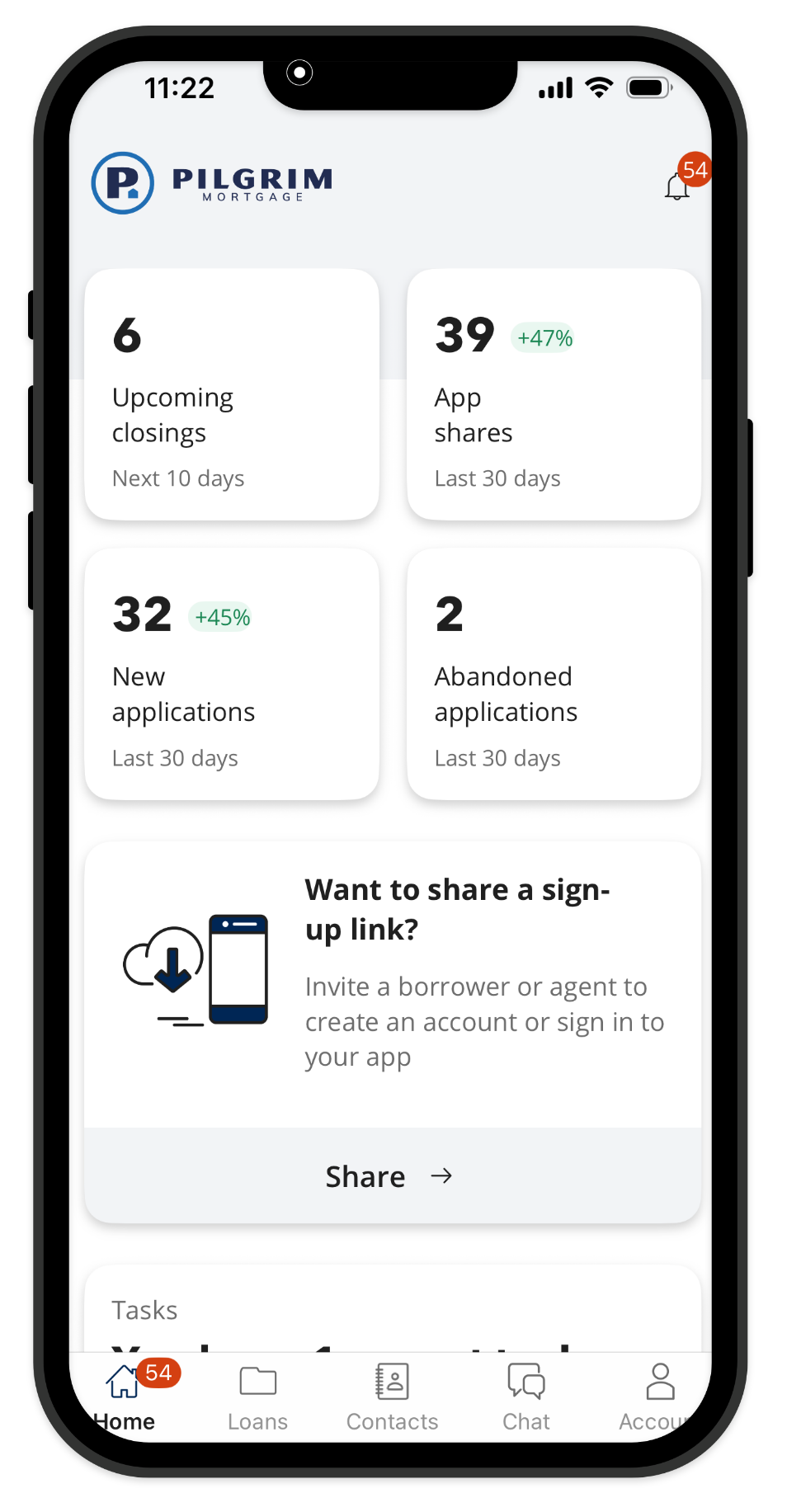

our technology

Encompass

With the industry’s only true end-to-end digital mortgage solution, you can acquire more customers and originate, sell and purchase loans faster — all from a single system of record.

Nexus Vision

Providing out-of-the-box dashboards and reports, Nexus Vision equips mortgage lenders with turnkey, enterprise-grade business intelligence. It improves visibility and increases productivity across the entire organization.

Simple Nexus

The homeownership platform uniting people, systems and stages of the mortgage process into a seamless end-to-end solution. With one login, we streamline each stage of the mortgage transaction into an efficient, single-platform experience.

Usherpa

A purpose-built CRM and customer engagement platform design to create growth and loyalty for the modern lender, Usherpa is an “expert” itself with pre-built integrations to your LOS, third party lead sources, social media and more.

the marketing

team

social media content library

usherpa crm

quick turnaround graphic design

ongoing advertising support

“I have increased my volume since joining Pilgrim. A lot of that is due to leadership, products and marketing, which has allowed me to focus on new business instead of sitting in the office processing loans.”

Dino Lumbala

Loan Officer | Houston, TX

“I’ve been in this business a long time, and I’ve never had a partner like Pilgrim. Wes leads with vision and integrity—and that filters down through every corner of the company. Year after year, my business has grown, and I’ve never felt more supported or more confident in what I’m building.”

Cary Tennis

Senior Loan Officer, 2023 Top Producer, 2024 Top 5 Producer | College Station, TX

“Pilgrim gave me the runway — and the right people in my corner — to take my business to the next level. The culture here isn’t just supportive, it’s strategic. They don’t just want you to succeed—they make sure you have every tool to do it.”

Kaelen Cheatham

Loan Officer, 2024 Top Producer, 2023 Top 5 Producer | San Antonio, TX

The Latest on LinkedIn

join pilgrim mortgage

join@pilgrimmtg.com

(210) 449-4200